All Categories

Featured

Table of Contents

These notes allow you buy small companies, offering them with the funding needed to grow. In exchange, you can make a repaired return on your financial investment (Private Real Estate Deals for Accredited Investors). For instance, if you purchase our note with a 14% annualized return, you receive your interest payments plus the principal at the end of the 2 year term.

Due to the fact that this type of financial investment is usually not available to the public, realty can use recognized investors unique chances to diversify their portfolios. Nonetheless, realty financial investments can also include downsides. Offers typically need significant capital and lasting commitments as a result of high up-front high capital investment like purchase rates, maintenance, taxes, and charges.

Some investments are just open to accredited capitalists. Here are the leading 7 recognized capitalist possibilities: Special accessibility to personal market investments Wide range of alternative investments like art, genuine estate, legal funding, and more Goal-based investing for development or income Minimums starting from $10,000 Invest in pre-IPO companies via an EquityZen fund.

Investments entail risk; Equitybee Stocks, participant FINRA Accredited financiers are the most qualified capitalists in business. To certify, you'll require to satisfy one or even more needs in revenue, net well worth, property size, administration standing, or specialist experience. As an accredited capitalist, you have access to more complicated and advanced types of protections.

Exclusive Real Estate Deals For Accredited Investors

Enjoy access to these alternative financial investment possibilities as an accredited financier. Continue reading. Approved financiers normally have an earnings of over $200,000 individually or $300,000 jointly with a spouse in each of the last 2 years. AssetsPrivate CreditMinimum InvestmentAs low as $500Target Holding PeriodAs short as 1 month Percent is a personal debt financial investment system.

To gain, you just require to sign up, invest in a note offering, and await its maturity. It's an excellent source of passive income as you don't need to monitor it closely and it has a brief holding period. Great annual returns vary between 15% and 24% for this possession class.

Prospective for high returnsShort holding period Funding in jeopardy if the consumer defaults AssetsContemporary ArtMinimum Investment$15,000 Target Holding Period3-10 Years Masterworks is a platform that securitizes blue-chip art work for financial investments. It gets an art work through public auction, after that it registers that asset as an LLC. Starting at $15,000, you can buy this low-risk property course.

Get when it's supplied, and after that you get pro-rated gains once Masterworks markets the art work. Although the target duration is 3-10 years, when the artwork gets to the wanted worth, it can be offered earlier. On its internet site, the ideal admiration of an art work was a whopping 788.9%, and it was only held for 29 days.

Its minimum starts at $10,000. Yieldstreet has the broadest offering throughout alternate investment platforms, so the quantity you can earn and its holding period vary. Accredited Investor Property Portfolios. There are products that you can hold for as short as 3 months and as long as 5 years. Commonly, you can make with returns and share appreciation in time.

What is the best way to compare Real Estate Investing For Accredited Investors options?

It can either be paid to you monthly, quarterly, or when an event takes place. One of the downsides below is the lower yearly return rate contrasted to specialized systems. It supplies the exact same items, some of its competitors surpass it. Its management cost normally ranges from 1% - 4% annually.

As a financier, you can make in 2 methods: Receive returns or money yield every December from the lease paid by occupant farmers. Gain pro-rated income from the sale of the farmland at the end of the holding period.

How can I secure Exclusive Real Estate Deals For Accredited Investors quickly?

If a home gains sufficient worth, it can be marketed earlier. One of its offerings was shut in simply 1.4 years with a 15.5% understood gain. Farmland as a property has historically low volatility, which makes this an excellent option for risk-averse investors. That being claimed, all financial investments still lug a certain degree of risk.

In addition, there's a 5% cost upon the sale of the whole property. It spends in different offers such as multifamily, self-storage, and commercial residential or commercial properties.

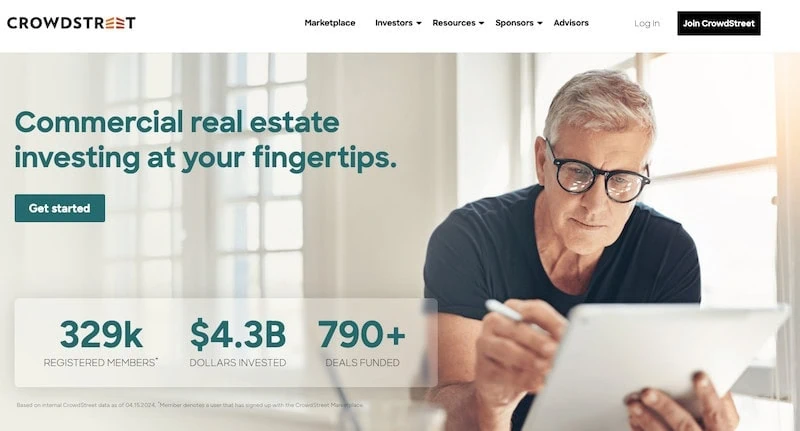

Taken care of fund by CrowdStreet Advisors, which immediately diversifies your financial investment across numerous residential properties. When you buy a CrowdStreet offering, you can get both a money yield and pro-rated gains at the end of the holding period. The minimum financial investment can vary, however it typically begins at $25,000 for marketplace offerings and C-REIT.

What is the most popular Accredited Investor Real Estate Platforms option in 2024?

Actual estate can be generally reduced threat, but returns are not ensured. In the background of CrowdStreet, more than 10 properties have adverse 100% returns.

While you won't obtain possession below, you can possibly get a share of the revenue once the startup effectively does an exit occasion, like an IPO or M&A. Numerous excellent firms continue to be exclusive and, as a result, typically unattainable to financiers. At Equitybee, you can fund the supply alternatives of workers at Red stripe, Reddit, and Starlink.

The minimal financial investment is $10,000. This platform can potentially provide you large returns, you can additionally lose your entire money if the startup falls short.

Why should I consider investing in Commercial Real Estate For Accredited Investors?

So when it's time to exercise the choice during an IPO or M&A, they can benefit from the potential rise of the share cost by having a contract that enables them to get it at a price cut. Accredited Investor Real Estate Deals. Access Hundreds of Startups at Past Valuations Expand Your Portfolio with High Growth Start-ups Spend in a Formerly Hard To Reach Asset Course Subject to schedule

It likewise uses the Climb Revenue Fund, which invests in CRE-related senior financial debt loans. Historically, this earnings fund has surpassed the Yieldstreet Alternative Earnings Fund (formerly recognized as Yieldstreet Prism Fund) and PIMCO Income Fund.

Various other features you can invest in include acquiring and holding shares of business rooms such as industrial and multifamily homes. Some users have actually whined about their absence of transparency. Evidently, EquityMultiple doesn't connect losses promptly. And also, they no more publish the historical efficiency of each fund. Temporary note with high returns Lack of openness Complicated costs structure You can certify as a recognized financier utilizing 2 requirements: financial and expert capacities.

Latest Posts

Local Tax Delinquent Property List

Buy Houses That Owe Taxes

Tax Sale Unclaimed Funds